When the bubble bursts...

Published on December 08,2017

Let’s begin with an astounding fact. Visit Karen with an aim to buying a residential home.

The double storey building above, located in Sendai, Karen costs Ksh.70,000,000 ($USD 679000) to purchase. If you were an investor and decides to purchase the house and then rent it out for ksh.250,000 ($USD 2425) a month; then maths has it that, it would take you 280 months (23 years) for you to return your money. In plain terms, for all those 23 years, you will not be making any profit at all. Bear these in your mind:

- 23 years was enough time for the young lad Jesus, 12 years old, to live his life up to 30, begin his God-assigned mission and see it to completion, and then go back to his Father. Still leaving the world two more years for mourning over what happened.

- Ruling out corruption and allowances, it would take a kenyan president with their basic salary of approx. 1.4M, close to a full term to purchase the property. Basically, it would take a normal kenyan of middle class (the rich and poor being unique) with an average salary of 70,000 a month, which 80% of kenyans are yet to attain, 83 years ( a blessed long life) to purchase the house. That is if they save all/spend zero of their income.

- 70,000,000 is enough money for your beloved ones to spend in educating themselves in any precious world university like MIT, and it’s enough for 58 medicine students of Harvard or John Hopkins for the seven year degree.

- 70,000,000 is enough money for a car addict to buy 16 Audi A3 four wheel drives. Or enough to be used to build close to 100 nice ‘simple’ houses.

The point is, something is wrong with our real estate market. The something I speak of is a market bubble.

What is a bubble?

By definition, an economic bubble is an asset value that temporarily booms and eventually bursts, plummeting back to its lows based on changing investor psychology, rather than underlying fundamental economic drivers that are sustainable over time. As an example, imagine you have been tasked by your mom to help her transport a bagful of mangoes to the market, and as soon as you arrive, you are to begin selling before she arrives to relieve you. She instructs you to sell a mango for Ksh.5 ($USD 0.048). Seeing an opportunity to exploit the ready-mango-eaters (since you were the first mango dealer to arrive in the market), you decide to sell a mango for ksh.10. Demand being high, the customers buy your mangoes albeit they are cursing the fact that they would not be able to purchase a matchbox since their five shillings is gone too. In business world, the opportunity cost of buying your mango, is a whole absence of lit fire in the house (since you spent the matchbox money on a mango):-no food to be cooked tonight. As the day progresses, your customers resort to buying a different item altogether, say an avocado, for a mere ksh.5. The same lust for fruits is satisfied, except by a product not of yours. So you will either be forced to decrease your price back to ksh.5 to allow your customers to purchase a matchbox, or you literally run out of business. Either way, an astounding effect is left piercing you greedy heart.

So why is our real estate market likened to the greedy business person above?

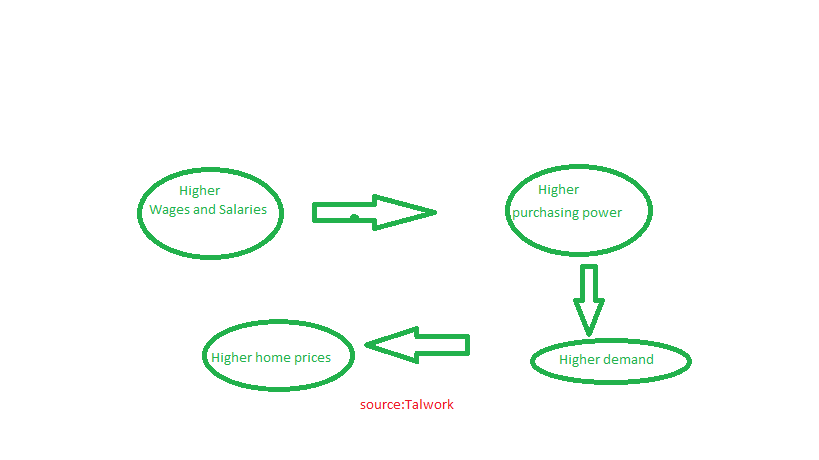

For a real estate economy to be rendered a bubble, the underlying fundamental economic drivers for the sector has to be showing opposite signs other than supporting its growth. For a real growth in the real estate market, the consumer’s purchasing power has to also increase at the same rate as that of the home prices. A high home consumer purchasing power means that their wages are also high. Study the below arrow diagram.

This ought to be the natural flow of market forces in home purchase in the real estate market, but our figures speak something else.

Source:kenya national bureau of statistics; economic survey 2017

Wage earnings increased from KSh 1,509.1 billion in 2015 to KSh 1,647.1 billion in 2016,

representing a rise of 9.1 per cent. Annual average wage earnings grew by 5.9 per cent from

KSh 608,991.7 in 2015 to KSh 644,837.9 in 2016. Real average earnings per employee per

annum increased from KSh 379,528.7 in 2015 to KSh 379,852.7 in 2016. Annual inflation

eased from 6.6 per cent in 2015 to 6.3 per cent in 2016.

Home prices on the other hand have been rising sharply where by instead of talking of qualitative increments of percentages, we are rather talking of quantitatives of doubling, tripling, and quadrupling over a short period of time.

So the situation is such that income is ‘up’ by 9.1%, while house prices are up by, let’s talk about the lower scale of 70%, over a period of 5 years. The income to house price index ratio is something like 1:7 on the lower scale; which is clearly a formula of chernobyl -like disaster for the real estate economy.

Where did the rain start beating us?

As from the definition, bubbles are inflated and deflated by changing investor psychology. The pump owners in this sector are generally speculators. Have you ever reaped fruits from a tree leaving the tree with close to no fruit? If yes then you are greedy, for the bible says, you have to leave a few fruits for that stranger passing by. This menace of greed, which nowadays has graduated itself to the level of being likened to a necessary talent, (as some of our leaders use it as a stepping stone to political power), is the same force driving the real estate market speculators.Everything in this market was just doing ok when real investors were in the market, until that day team mafisi (lust admirers with little or no balls to go for what they want because they lack what it takes) graduated to real predators, making their own big kills better than the casual predators.

How do they defend themselves?

- Slow and costly property tilting systems. The legal fee, sales and mortgage registration are pricey and the process is sluggish.We can take an instance of the subdivision of small portions of lands for construction which can take ages. Warning: instead of rooting out their problem, they resort to creating others (even worse in the end) in the pretext of solving the original problem. Wisdom has it that, for every lie you tell, you will have to use another lie to cover up the original lie hence making life complexly impossible, for the cost of generating a lie is much much greater than pick and placing the already existing truth.

- Construction cost. The expense of construction currently in Kenya is at an estimate of 30% to 40% higher than many other countries. This is indeed very true, but the root of this is the same guys complaining. Why would you pay me 1000,000 to construct you a house worth 70,000,000. Even a monkey would take you for a fool and give its often amazing look.

- Costly prices of land. Land in Kenya is also in scarcity especially in urban resulting to increased demand and competition. Land prices rose because of their high demand and low supply. This is a very natural market force interaction. But why ship in your own artificial greed?

And when the bow breaks…no more arrows will be fired.

The bubble will finally burst when excessive risk-taking becomes pervasive throughout the housing system. This happens while the supply of housing is still increasing. In other words, demand decreases while supply increases, resulting in a fall in prices. When it actually bursts is not known to anyone. Or rather, home buyers and renters would rather resort to other alternatives like renting cheaper houses and avoiding the much expensive ones and instead of buying, they build their own, the cost of building being cheaper compared to that of buying one.

What happens when a balloon bubble bursts? Does the child continue playing happily as before, as if nothing did happen? or does a wound fester in her heart and spread rapidly like a forest fire to engulf its environment? The answer is known even to the fellow toddlers.When the bubble bursts, it means the prices of the real estate properties will fall sharply. The effects are :

- High loss of jobs for the construction industry as many will shun away from the real estate sector since returns are close to worthless. Real estate agents, house insurers will also be heavily affected.

- Lack of trust in the mortgage industry and its accompanying death of an important industry which is still very immature for kenya. This will directly affect even the private credit lending by the financial institutions, most kenyans being entirely dependent on credits for living.

- Many will lose their homes if mortgage purchased as some mortgage rates are adjustable depending on the performance of the real estate economy.

- A fall in other economic sectors as real estate is a direct driver of other sectors like the stock market, and the finance and insurance sector.

It would be prudent if one makes his investment decisions wisely, like going to invest in those areas where overambitious ‘investors’ have not yet laid their eyes on. But even these are part of the same sector, the big guy fall and so does the little, the only motivation is that the small guy is closer to the ground hence more stable. And even if he falls it won’t be that hefty. Clearly, intensive studying of the economy is necessary before any investment is made. Kenyans are also left with two choices: to either deflate the balloon or pop it out. But which are we really going for, as of now?