Your money is just paper

Published on May 17,2018

Money misunderstood

Studying the behaviour of market participants, it is quite clear that the seller wishes to sell an item but with a goal in mind. Let’s say he wishes to sell breads in order to see his child to school with the fee. The buyer on the other hand doesn’t have a hidden agenda in mind, she simply wants that bread for breakfast. But there is no time the seller will ever sell bread and having the buyer directly take the seller’s kid to school as a form of exchange. No, that doesn’t happen in the modern economy. So, how then does the seller fulfil his goals? The buyer leaves him with something, money; that he may use this money to take his kid to school. Money is simply a means to an end and not the end. And when the seller doesn’t have an immediate goal in mind, at least leave him something of equivalent value that they may hold on to, that in future he may exchange it for what he may want. Money exists to facilitate this exchange, functioning as a “medium” or middle part of a transaction. In a modern economy, every time someone purchases something, that person engages in half of an exchange: one thing of inherent value has changed hands, with the buyer getting what he or she wants, but the seller still looking to get something of value in return. That is why money is simply a medium of exchange. You cannot eat it. Someone exchanges a good from you for money, that you may use that money to acquire something else of your own need. Money is simply a token given the seller signifying that he or she is still owed something of value. But what is money, and why trade anyway?

Trade demystified

Say you have you given Mike, your school child, a piece of cake baked with eggs that he may eat it at breaktime. But Mike rarely loves your gift and on a scale of 1 to 10, he rates the value of his cake to a 6. Then there is this friend of his called Maggy. On that day of school Maggy carried yoghurt for her breaktime. Maggy hates yoghurt and on the same scale of 1 to 10, Maggy rates her yoghurt to a mere 4. During the breaktime, the two unpacks their food together but soon each one of them would be extremely amazed. Mike loves yoghurt so much that he requests Maggy to exchange her yoghurt for his cake. On the same scale Mike would rate yoghurt at 9. Maggy also have some liking for cakes and would rate it at a 7. Purely due to love for the other thing, the two friends agree to exchange their goods. In the end Mike has Maggy’s yoghurt rated at 9 by him (much higher than his cakes rated at 6). In simple sense mike has a good valued at 9 or 90% from the initial 6 or 60%. Maggy on the other hand has Mike’s cake that she rates at 7 (much higher than her own yoghurt that she rated at 4). So, Maggy has a good valued at 7 or 70% from the initial 4 or 40%. In either of the two scenarios, the value of an item has increased. (The total value has also increased from 10 to 16) What one deemed worthless is now very worthy for another. One man’s trash is another man’s treasure. And that is purely the essence of trade, to increase the value of an item.

History of money

As long as my grandfather recalls, they used a smart system called barter trade. If you needed an item say, jerrycans (they used moulded ports anyway) for water holding but the only item you have in excess are cows. Then you would pick a cow, walk it to an exchange market (which might have been the neighbourhood), find some one in need of cows and willing to exchange his/her jerrycans. The two of you would then value your items for an appropriate exchange to take place say 50 jerrycans (pots) for a cow. Then everyone goes home very satisfied. No medium of exchange involved, no need to hold something you cannot consume for now. You want this, come get this instantly.

As the world modernized, people soon realized that when you need an already built house, it would be quite difficult to find one ready at that instance, so it will be good to wait. So, the prospective buyer of the house would have to wait, but they can’t do just that while also keeping their medium of exchange, say cows, untouched. At one point, while the house is still yet to be constructed, the prospective buyer might need meat; obviously they will slaughter their cows (prospective medium of exchange). But what if they would have exchanged the cows for some other thing they cannot consume in one way or the other, but can be kept for future use? That would be perfect, isn’t it? And so, media (plural for medium) of exchange arrived in the market. It all started with precious metals such as gold and silver whereby an ounce of gold would be tied to a specific value, people soon started crafting the precious metals into unique disc shapes to form coins for exchange. Then it went to specially crafted metals with much less value, say steel or copper, in which a controlled amount of the precious metals was alloyed into. Metal being difficult to craft, and the precious metals being non-renewable, their usage became limited and then people jumped to bills of exchange, such as postage stamps and the paper notes. Not that they have value, but because the regulatory body i.e. the government has allowed them to be used as media of exchange. Simply say, paper also became the legal tender. Up to now, most economies use paper. There might be no problem with this but there is one indeed.

The gold standard

With the advent of paper money as the legal tender, business was now becoming easier than before. But if they are using paper, why not craft my own paper? If this were possible then a disorganized sluggard would become rich when he/she wanted; by simply crafting their own paper then going to the market with them. To ensure this doesn’t take place (i.e. no counterfeiting), the art of paper currency manufacturing had to be entrusted to one entity alone and maybe other authorized entities like private banks. The US entrusted theirs to the Federal Reserve, while most of other economies called theirs the Central Bank. So, in Kenya, for example, our paper or oven coin currency is manufactured by the Central Bank of Kenya (CBK). The problem comes in the control of printing. As in when is it the appropriate time to print? When is it not? How do we know that the amount printed is enough for the whole economy to use in trade? Say the CBK printed 10,000 notes (forgo the denominations/value e.g. 50,100,1000. Just assume that), how sure are they that these 10,000 notes in number would reach that old woman in the interior of the country side?

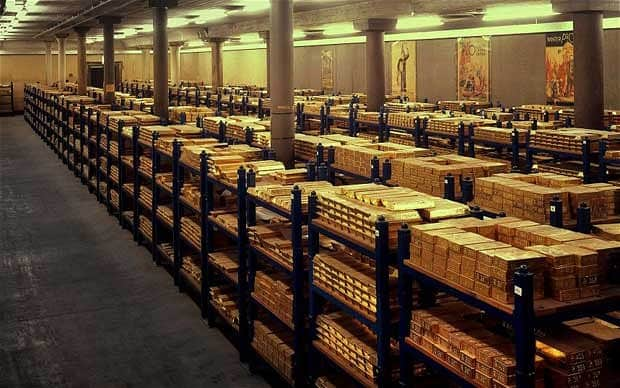

This proving difficult to control, most governments, notably the US, resorted to using Gold to control this printing. This is plainly how it is done. First the government must be owning some blocks of pure gold somewhere in the country. The Fed reserve bank, for the Us, as an example. This gold could have been acquired from the citizens, or from the government owned gold mines, or acquired through trade with other country. Let’s say the government owns blocks of pure gold worth shillings 10million. This value is called the value of the gold reserve. The Central Bank should only print paper plus coin whose total face value is equivalent to the value of the gold reserve. i.e. 10million in our case. In doing this, the amount and value of money printed/available in the economy is controlled by the amount of the government’s gold reserve. This also means that one can walk into a bank and on demand exchange a given value of money for a given amount of gold; the economy remains intact.

However, much of the money used under gold standard is not gold, but promises to pay gold. Also, gold is a non-renewable resource (to mean once dug out of a mine, the mine gets depleted of gold), and is entirely subject to fluctuations in value and number, due to trade. So how best a country trades on gold, or how wealthy a country is in gold, say Australia or South Africa, would control its economy. Gold’s value and amount however changes nicely and this would save the country from unnecessary inflations and deflations. But still a government might still change its gold-to-money ratio in order to change the money supply into the economy. The US changed the gold-money ratio from $20.67 to $35 in the year 1933. Also, during wars the value of gold can change dramatically leaving a country’s economy unstable.

Fiat money

For the US, the gold standard ended in 1933 when the federal government halted convertibility of notes into gold and nationalized the private gold stock. The dollar was devalued in terms of its gold content, and made convertible into gold for official international transactions only. Even this quasi-gold standard became difficult to maintain in the 1960s. Over the period 1967-1973, the United States abandoned its commitment to covert dollars into gold in official transactions and stopped trying to maintain its value relative to foreign exchange. Despite several attempts to retain some link to gold, all official links of the dollar to gold were severed in 1976. And so, the world’s biggest economy shifted to a fiat money system.

What do I mean by fiat?

Fiat money, also elastic money, has no intrinsic value (no value of its own) or representational value (not representing anything of value, such as gold). As the name suggests, fiat money is created by a government decree—an official government order that the money is legal tender for carrying out transactions or paying taxes. Some ladies and gents just sit on a round table and decide. A fiat money system is good in that it gives the central bank the flexibility it needs to expand or contract the money supply to provide economic stability—in other words, it is an “elastic” money supply. An elastic currency gives a central bank the flexibility to use monetary policy to smoothen the business cycle and maintain economic conditions conducive to a healthy economy. When the government wants to construct a big project of hers, it can decree money printing. It is simply useless paper in use. No string attached to it. If I decide to burn down the already printed notes in the CB, they will simply print more to replenish it. in fact the 2018 movie Den of Thieves, will acutely show you the destiny of this 'used-up' fiat money.

Here is the problem.

After the upheavals of the Great Depression and World War II, International monetary agreements called for a new system of fixed currency rates tied to the U.S. dollar, the value of which was tied to gold. Under this system, dollars could be redeemed for gold by foreign governments as part of international trade operations. It was not until 1971 that the United States stopped the redemption of dollars for gold altogether, thereby completely abandoning the gold standard. But the world’s currencies are still tied to this baseless currency of the US dollar. Their value depends on the US dollar’s value, which depends on one nation’s feelings, which depends on one private institution’s feelings (the Fed), which depends on its board of directors’ feelings, which ends on the hands of some guy(s). When one hears of the top 1% of the top 1%, these are the enlightened ones. Coming up with your own currency with a base wont really end well for you, for you are simply chasing the lion from his kingdom of stay. Worse yet, the world is into another funny money system. One controlled by the geniuses, but simply boils down to 0s and 1s. it is as if they are using George Boole’s mind to control the whole world. But Boole is human, hence subject to death and so is the system. Cryptocurrency, albeit controlled by no ambitious entity, would soon be in the able hands of man’s mysterious 'existential threat, AI', at least according to Elon Musk.