Kenya’s Big Debt: On a path to financial crisis

Published on July 18,2018

Introduction

Kenya is the East Africa’s largest economy, one of Africa’s most visited tourist destinations, and also the E. Africa’s IT hub. Not to brag, but Kenya is also the world’s leading tech centre in mobile money technologies having seen the rise of MPESA, Airtel money, T-Kash, and other bank-owned technologies. To inflict a wound on a new born baby, however, Kenya also houses one of Africa’s largest hungry bellies (hunger for free resources). With a corruption index of 28, second worst in East Africa only after Burundi, this means that the country only managed to score 28 points out of 100 on the 2017 Corruption Perceptions Index reported by Transparency International. 28 is the country’s all-time high (to mean poorest score since independence). Worse yet, there is this looming danger that is threatening to plunge the economy on an ocean floor just like Greece. The Kenyan government debt (both internal and external) has become a subject of worry and conspiracies of late. It is a conspiracy I wish to explore and give the citizen a status quo on the subject. Have a nice read.

‘Funny’ facts

- The public debt moved from Sh3.89 trillion in January last year to reach Sh4.58 trillion in November. Meaning? A total of Sh690 billion was borrowed during the period. An outstanding borrowing rate of approx.69 billion a month for the 2017 year (no wander why the country recorded the worst CPI of 28 that year). Who borrows like that?

- A total debt of 4.58 trillion (and counting) means that if say the 2019 population census records a 50million population for the country, then each and every Kenyan citizen then (assuming the debt stays the same) would be owing the government Ksh.91, 600. Approximately, a 4-month salary for a Kenyan primary school teacher.

- The country’s GDP per capita (the economic worth of every person in the economy, assuming that you can contribute as much as everyone else) has managed to stay above debt per capita (debt owed by every Kenyan) over the years, with 2017 estimates being at Sh151, 000 and Sh92, 000 respectively. However, debt per capita has grown faster at an eight-year compound annual growth rate of 15.4 per cent as compared to GDP per capital at 9.8 per cent. To mean, soon enough, the debt a citizen owes will be much higher that what that citizen is worth. In simplicity of terms, you will be unable to control your debt. Data source:- Cytonn Investments.

- The Standard Gauge Railway project (SGR) is expected to sink the country into at least $10 billion (Sh1 trillion) debt. This accounts for at least 22 per cent of Kenya's total public debt. Astonishingly, it’s all from China (the PRC). This is bad considering the fact that China has also funded, and continues to fund other major projects in the country.

The status quo compared to other African nations

What is Public Debt to GDP ratio?

A government’s Public debt is simply the total amount of money owed by that government to the lenders. Lenders can range from the country’s citizens (this constitutes the Internal debt) to foreign government and foreign monetary institutions. As an example a loan from People’s republic of China (PRC) to Kenya or a loan from the International Monetary Fund (IMF) to Kenya. These constitutes the external debt. Gross Domestic Product (GDP) on the other hand is simply the total value of all goods and services produced by a country. So if you take the debt and you put it over the GDP ( i.e. debt/gdp) then you have the Public Debt to GDP ratio, which can easily be converted to a percentage. The ratio is a big indicator of how stable an economy is. That is, its ability to repay debts, its economic performance and value/worth.

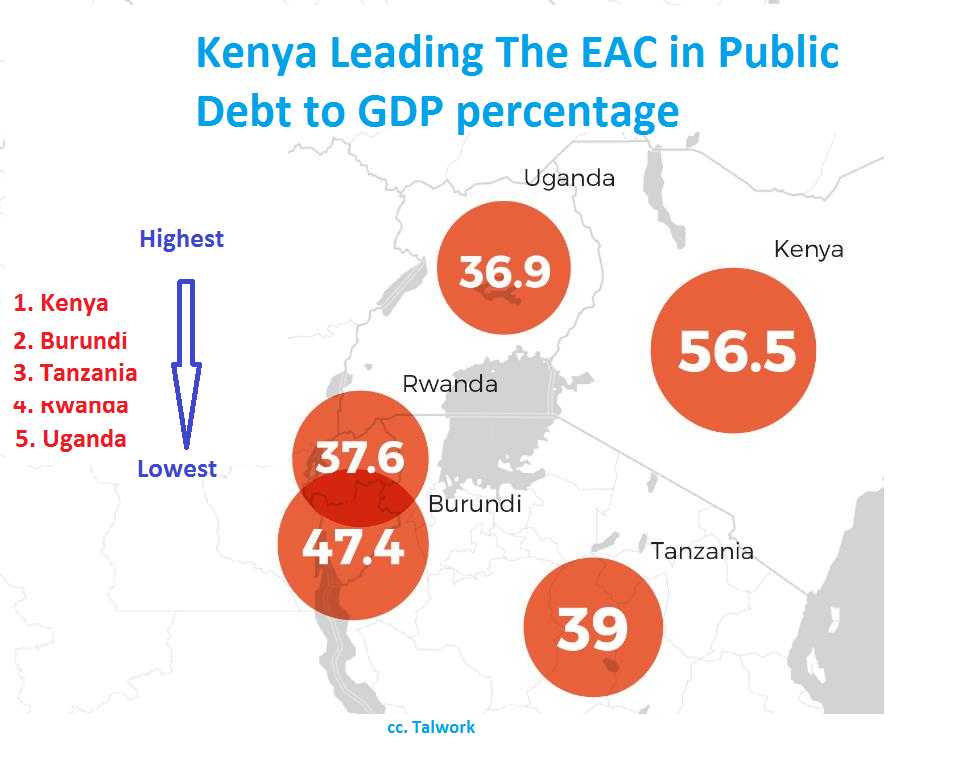

Kenya recorded its highest public debt and also its highest corruption index in 2017. Data by the Central Bank of Kenya recorded the government's internal debt at Sh2.22 trillion in November last year, while the external debt stood at Sh2.31 trillion in September 2017. From the figures, it put Kenya at number one in EAC’s Public Debt to GDP percentage.

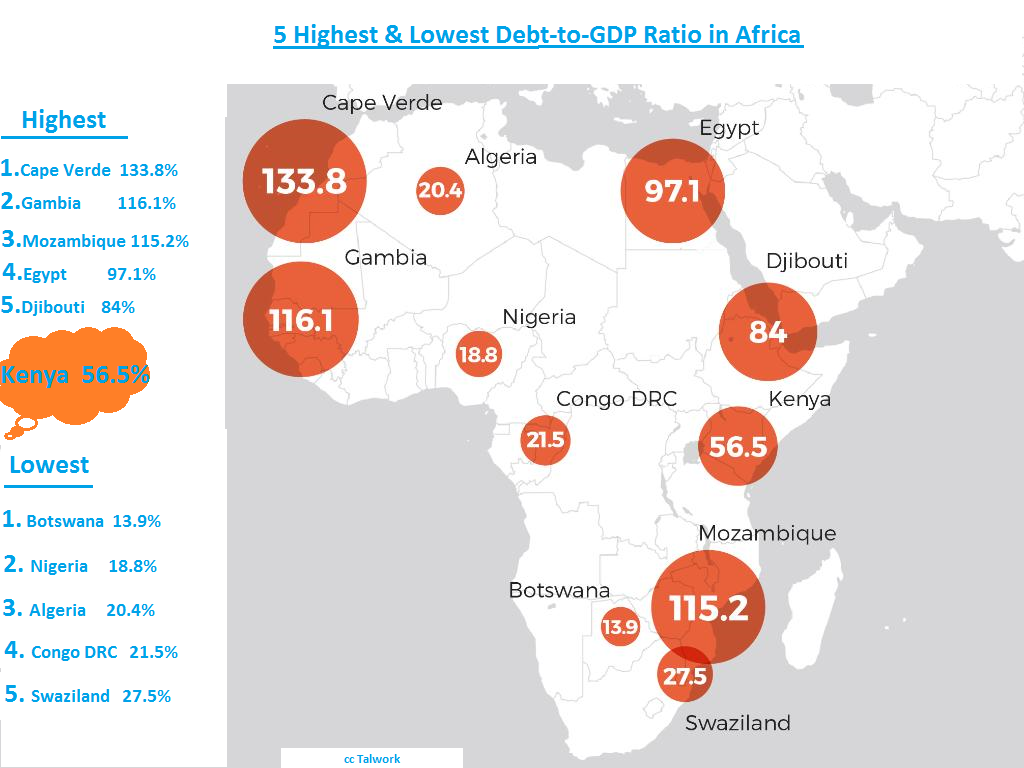

African-wise, based on Kenya’s ambition to rule in Africa economically, and also hampered by serious levels of corruption leading to misuse of borrowed funds, Kenya is on a wrong place.

Who are our biggest lenders?

Looking at individual governments, our highest lenders include China, Japan, and France. Kenya’s Loan from China stood at Sh520 billion as at December 2017. Compared to Japan that has lent the government Sh82.5 billion while the loan from France stood at Sh62.3 billion.

Lending from other monetary institutions including the World Bank and the IMF have also burdened the country further. Examples include a Ksh.77 billion eight-year commercial loan from Eastern and South Africa Trade and Development Bank.

Other loans include Sh75 billion from a five-year Eurobond issued in 2014. Supposed to mature in June 2019. Obviously an increased pressure in the coming year. There was also a Sh80.9 billion syndicated loan borrowed in 2016.

The government also owes its citizen about 50% of its total debt. This is its internal debt. Money that it raised through factors such as bonds and utilities sold to its citizens in order to finance some of its projects and also to repay other loans.

Are we owned by China?

The Chinese government has funded and still funds most projects in the Kenya. Notably, the Standard Gauge Railway, project is a form of loan from them. In totality it is expected to be Sh1 trillion. This is at least 22 per cent of Kenya's total public debt. The first phase of the SGR (the 472-kilometre stretch line from Mombasa to Nairobi) saw the Chinese banks and the government lend Kenya Sh327 billion. This was increased by another Sh150 billion to push the railway line to Naivasha. May 2016 also saw a new request by the GoK to loan ksh.370 billion from Exim Bank of China to finance the construction of the third phase of the SGR, a 270km-line between Naivasha and Kisumu. In totality, this is Ksh.850 billion. Other than numerous road projects being constructed by the Chinese in Kenya, there is also a 30-year investment for Olkaria IV, geothermal power project. A 100 billion investment back in November 2016. So, is Kenya owned by China?

Where is the problem?

Obviously, taking a loan is not a problem at all; and neither is taking a bigger loan. The question stands at, Are you able to repay these loans? But on further analysis, how one repays their loans also speaks much. If you invest using the loan borrowed, acquire ROIs and then repay your loan using the returns then this is entirely safe, appropriate, and the perfect economic way of doing things. However, if you borrow another loan in order to repay a previous loan, then what do we call this? Further, if you float your loans to a future date, bearing in mind that the loans accrue an interest, then what do we call this too? This is where Kenya is really failing.

For the past 10 years Kenya has invested heavily on infrastructure. It borrows a lot and uses majority of it on infrastructure. But will infrastructure bring returns as they expect? Will infrastructure repay the loans before they mature? This has proven to be untrue. Most economic experts have warned that the SGR will not repay its own loans. This will require taxpayers to incur an extra Sh15 billion to service them, putting to question the feasibility of the largest single infrastructure project in Kenya in recent times. It doesn’t take a genius to realize that if investment are made on projects that don’t bring enough and/or timely returns, then that economy may collapse.

As an example, late last year, announcing the extension to pay Sh75 billion syndicated loan (offered by a group of lenders) it took in 2015 from a group of 26 banks, by six months. 90 per cent of the investors in the loan had agreed to extend the maturity by six months until April 2018, while the remaining 10 per cent that did not want to extend were repaid on October 27. Notice that the loan was to address some of the interest rates pressures then and it attracted a 5.7 per cent interest. And this meant that an extension of the maturity meant the government incurred further interest rates.

Clearly, the GoK borrows further in order to repay loans. Clearly a recipe for disaster. You cannot borrow forever. This together with corruption that leads to misuse of the borrowed funds have resulted to further pressure on the taxpayer and this was witnessed this year during the new 2018/2019 budget reading. And this is what scares me. What about you, I would like to hear your mind by commenting down below.